Initiating coverage | JK Cement

March 12, 2015

JK Cement

BUY

CMP

`673

New Capacity addition to drive growth

Target Price

`778

Capacity expansion to drive growth: JK Cement (JKCem), a JK organization group

Investment Period

12 Months

company, has a grey cement capacity of 10.5mtpa catering to the markets of

North, West and South regions of India. 7.5mtpa of its plant capacity is located in

Stock Info

the North region (Rajasthan and Haryana) and the remaining 3mtpa is located in

Sector

Cement

the South region (Karnataka). This includes newly added capacity of 3mtpa in

Market Cap (` cr)

4,706

North India, comprising of 1.5mtpa split grinding unit each in Haryana and

Net debt (` cr)

2,434

Rajasthan, translating into an increase in capacity by 40%. JKCem started

Beta

1.3

production from these newly set up units during 1HFY2015. We expect production

52 Week High / Low

754 / 199

from these new plants to ramp up during FY2016. The Management guided that

Avg. Daily Volume

132,293

new plants’ utilization levels will reach

85%+ in the next two years. The

Face Value (`)

10

company’s North India plant (excluding new plant) is operating at 90% capacity

BSE Sensex

28,930

utilisation. Industry capacity expansion in the North region is expected to slow

Nifty

8,776

down going forward to 4.5% (CAGR) over FY2014-17 period as against the

Reuters Code

JKCE.BO

earlier capacity expansion rate of 5.8% CAGR over the FY2010-14 period. Hence we

Bloomberg Code

JKCE IN

believe that the output from JKCem’s new capacities (3mtpa) would be absorbed by the

market. We expect JKCem’s volume to grow at 16.4% CAGR during FY2014-17 on

account of the expanded capacity.

Shareholding Pattern (%)

Top 2 players in White cement business: JKCem has white cement capacity of

Promoters

66.9

0.6mtpa in Gotan, Rajasthan. There are only two major players manufacturing

MF / Banks / Indian Fls

9.5

white cement, one being JK Cem itself and the other being UltraTech Cement.

FII / NRIs / OCBs

16.6

Thus the utilization level is healthy led by stable demand for white cement. White

Indian Public / Others

6.9

cement contributed 31% to the top-line of JKCem in FY2014. White cement’s

EBITDA margins are higher and consistent at 25-28%, while the margins in grey

Abs.(%)

3m 1yr 3yr

cement have been volatile over the years. The company has doubled its white

Sensex

3.8

31.6

68.9

cement capacity to 1.2mtpa by starting production at the 0.6mtpa plant in UAE.

JK Cement

15.0

222.0

400.0

We expect white cement standalone business volume to grow at a CAGR of 7.0%

over FY2014-17 period.

Valuation: At CMP of `673 the stock is trading at 10.4x and 7.7x its FY2016E and

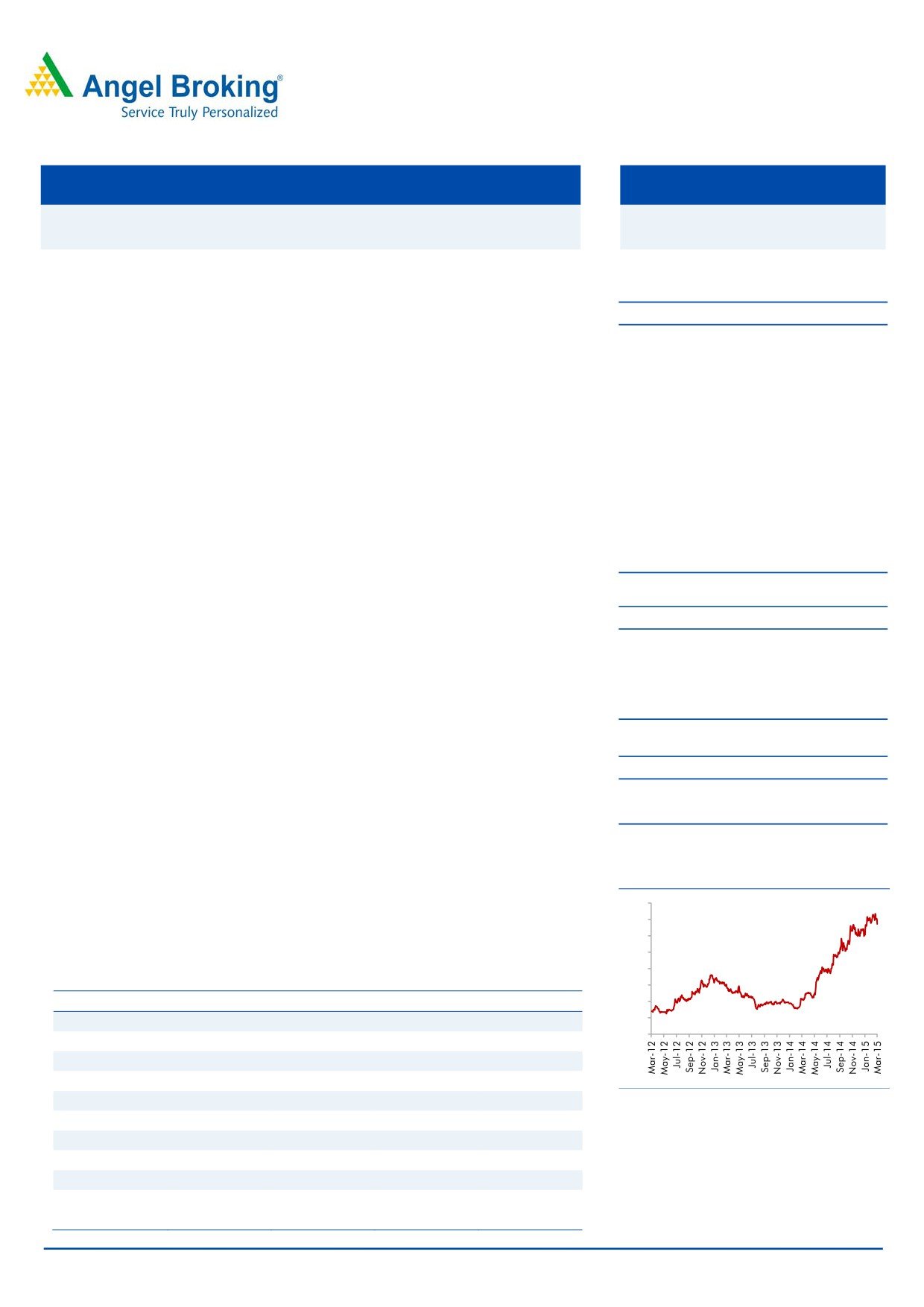

3-Year Daily price chart

FY2017E EV/EBITDA (blended), respectively. We initiate coverage on JK Cement

800

with a Buy recommendation and target price of `778 based on 8.0x grey cement

700

and 9.0x white cement FY2017 EV/EBIDTA; the target price implies EV/tonne of

600

500

$100 (on blended capacity of 11.6mtpa).

400

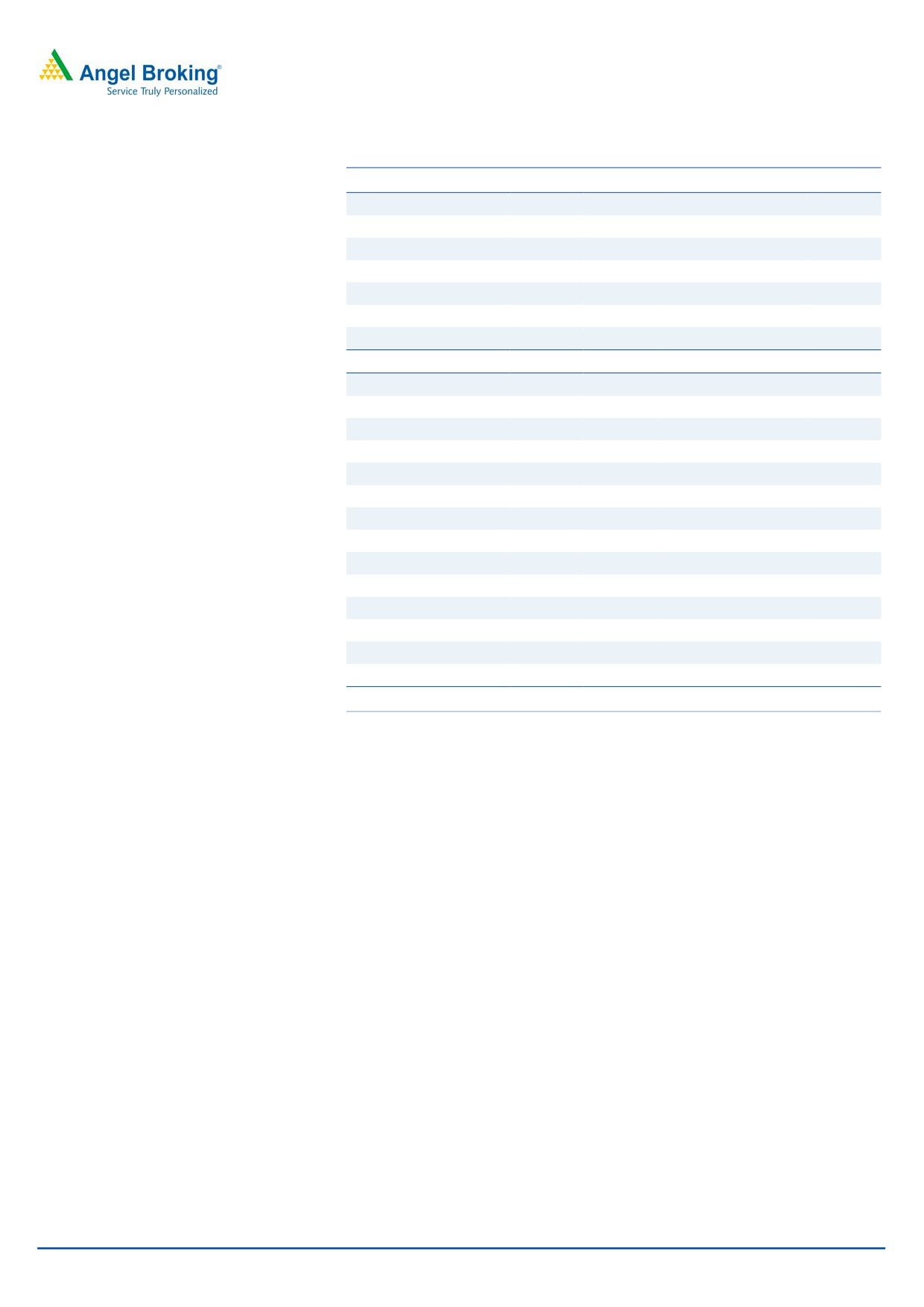

Key Financials (Standalone)

300

Y/E March (` cr)

FY2014

FY2015E

FY2016E

FY2017E

200

100

Net Sales

2,782

3,378

4,077

4,772

0

% chg

(4.2)

21.5

20.7

17.0

Net Profit

97

120

157

297

% chg

(58.5)

23.2

31.1

89.9

EPS (`)

14

17

22

43

Source: Company, Angel Research

P/E (x)

48.5

39.4

30.0

15.8

P/BV (x)

2.7

2.5

2.4

2.1

RoE (%)

6.4

7.0

8.2

14.3

RoCE (%)

5.8

6.5

10.1

13.8

Shrenik Gujrathi

EV/Sales (x)

2.0

2.1

1.7

1.4

022 39357800 Extn: 6872

EV/EBITDA (x)

15.4

15.7

10.4

7.7

Source: Company, Angel Research; Note: CMP as of March 12, 2015

Please refer to important disclosures at the end of this report

1

Initiating coverage | JK Cement

Investment Arguments

Capacity expansion to drive growth: JKCem has expanded its grey cement capacity

by 40% from 7.5mtpa to 10.5mtpa (7.5mtpa in North India and 3mtpa in South

India). This includes newly added capacity of 3mtpa capacity in North India,

comprising addition of 1.5mtpa split grinding unit each in Haryana and Rajasthan.

JKCem has started production at these units during 1HFY2015. We expect

production to ramp up during FY2016. The Management guided that the new

plants’ utilization levels will reach 85%+ in the next two years. The company’s

North India capacity (excluding the new plants) is operating at 90% utilization

levels. Industry capacity expansion in the North region is expected to slow down to

4.5% (CAGR) over the FY2014-17 period as against the earlier growth rate of

5.8% CAGR over the FY2010-14 period. Hence we expect output from the new

capacities (3mtpa) to be absorbed by the market.

We expect JKCem’s volume to grow at 16.4% CAGR over FY2014-17. The

ongoing capex cycle is over with 10MW waste heat recovery plant and railway

sliding at new plant getting operational in December 2014. Now JKCem is

expanding its white cement based wall putty plant of 0.2mtpa in Madhya Pradesh,

which would be operational by FY2017. The total capex required to be incurred on

this plant would be `100-150cr.

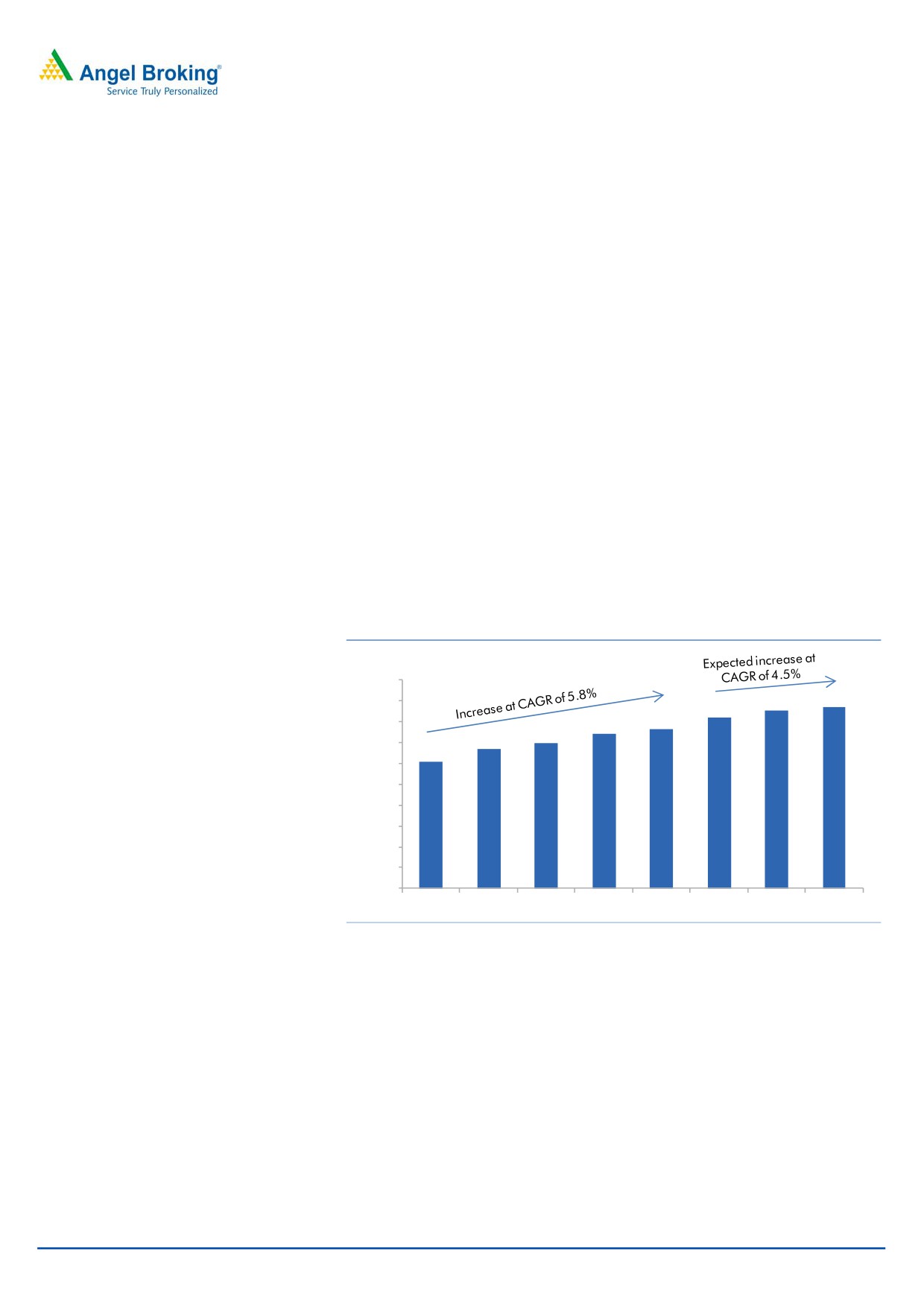

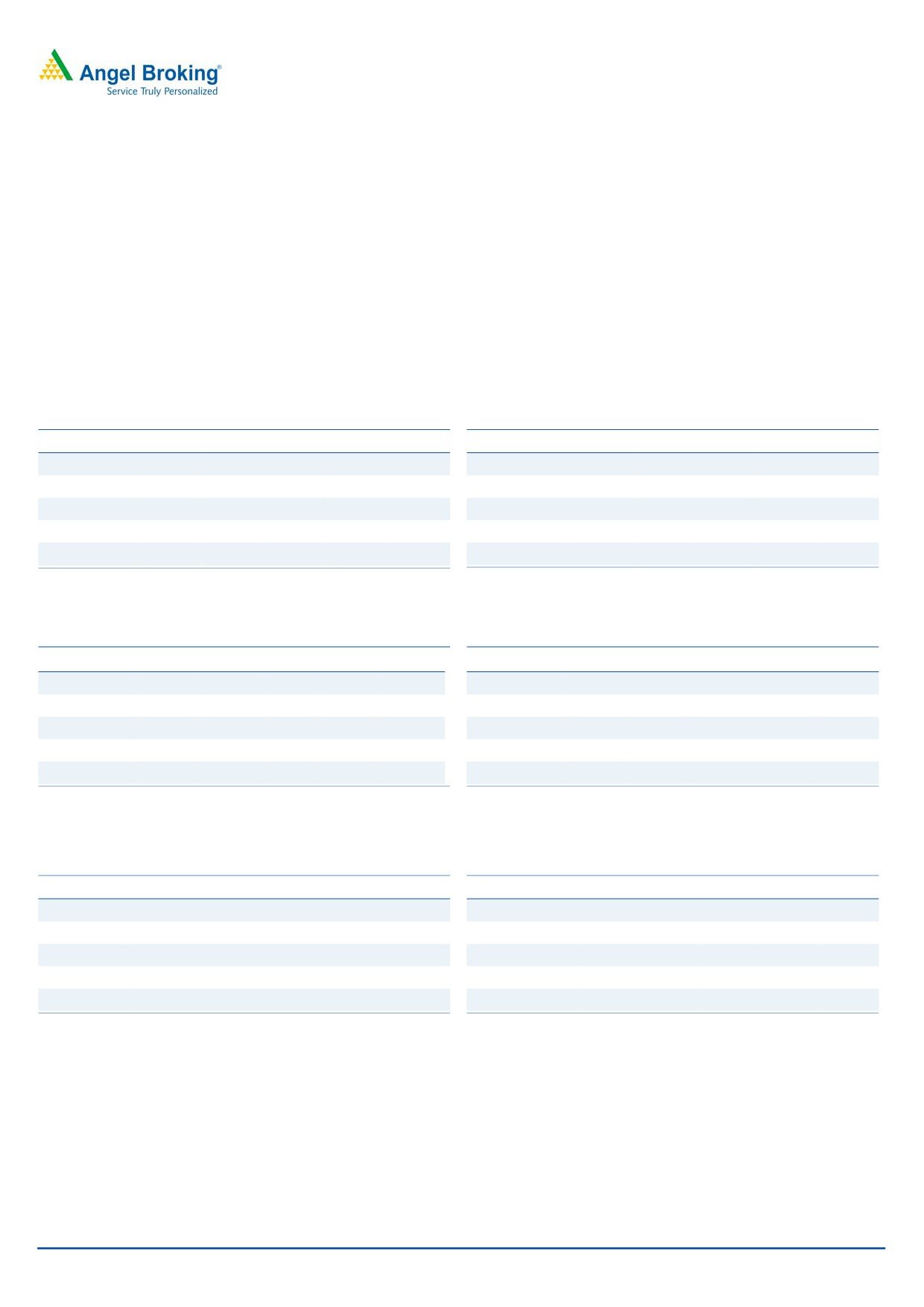

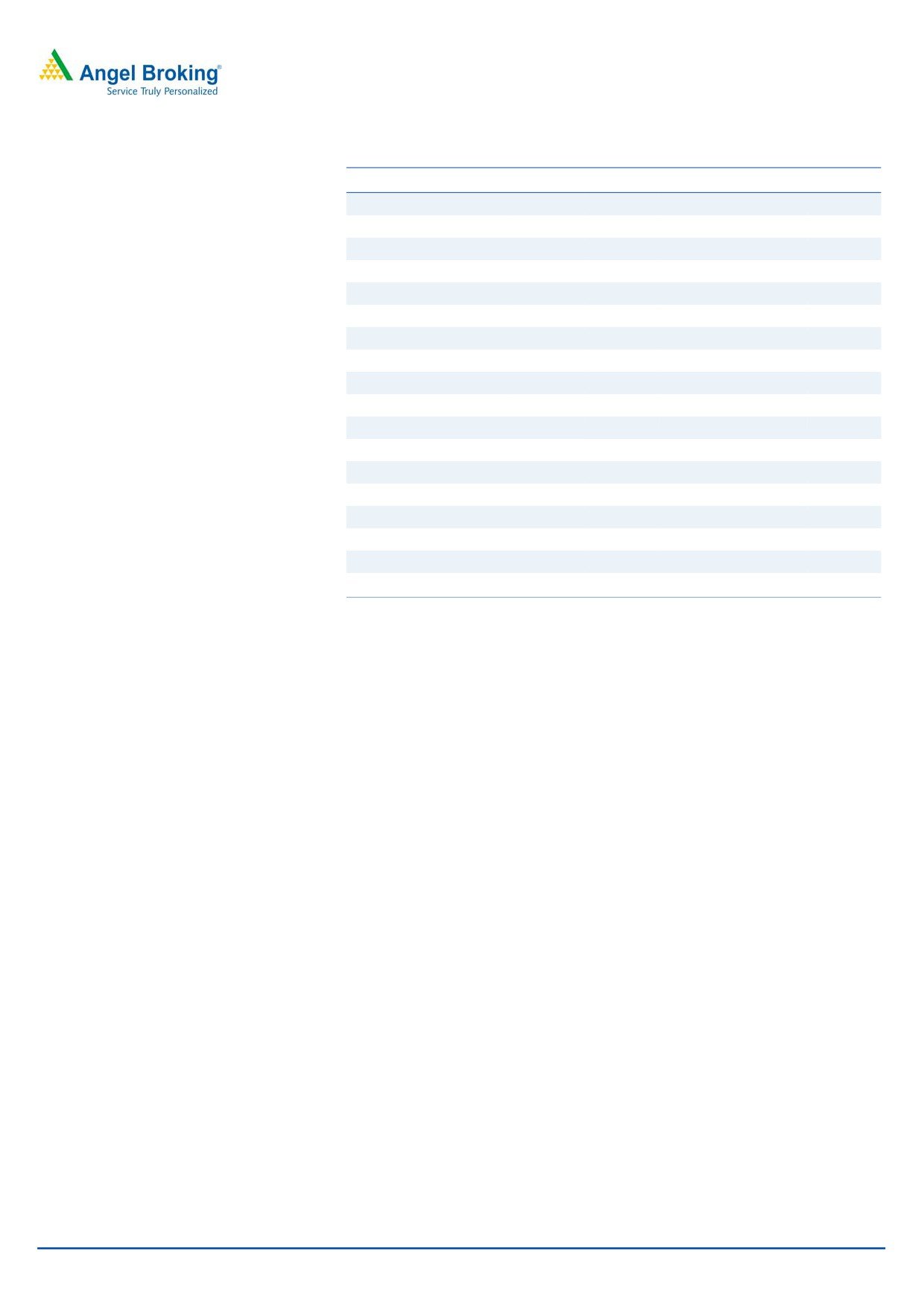

Exhibit 1: Industry Capacity expansion in North Region

(mn tn)

100.0

85.2

86.9

90.0

81.7

76.2

80.0

74.2

69.8

67.0

70.0

60.8

60.0

50.0

40.0

30.0

20.0

10.0

0.0

FY10

FY11

FY12

FY13

FY14

FY15E FY16E FY17E

Source: Company, Angel Research

March 12, 2015

2

Initiating coverage | JK Cement

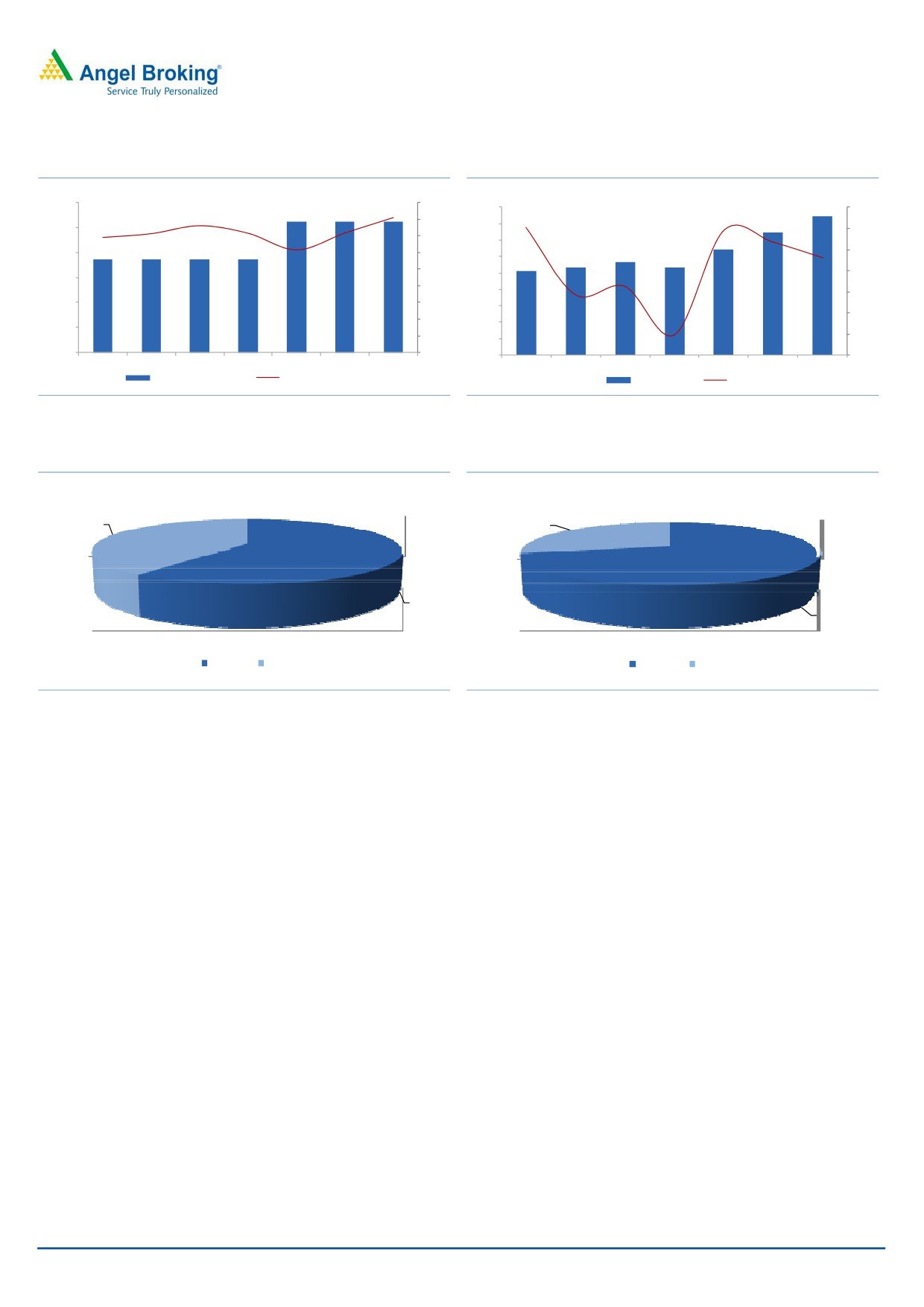

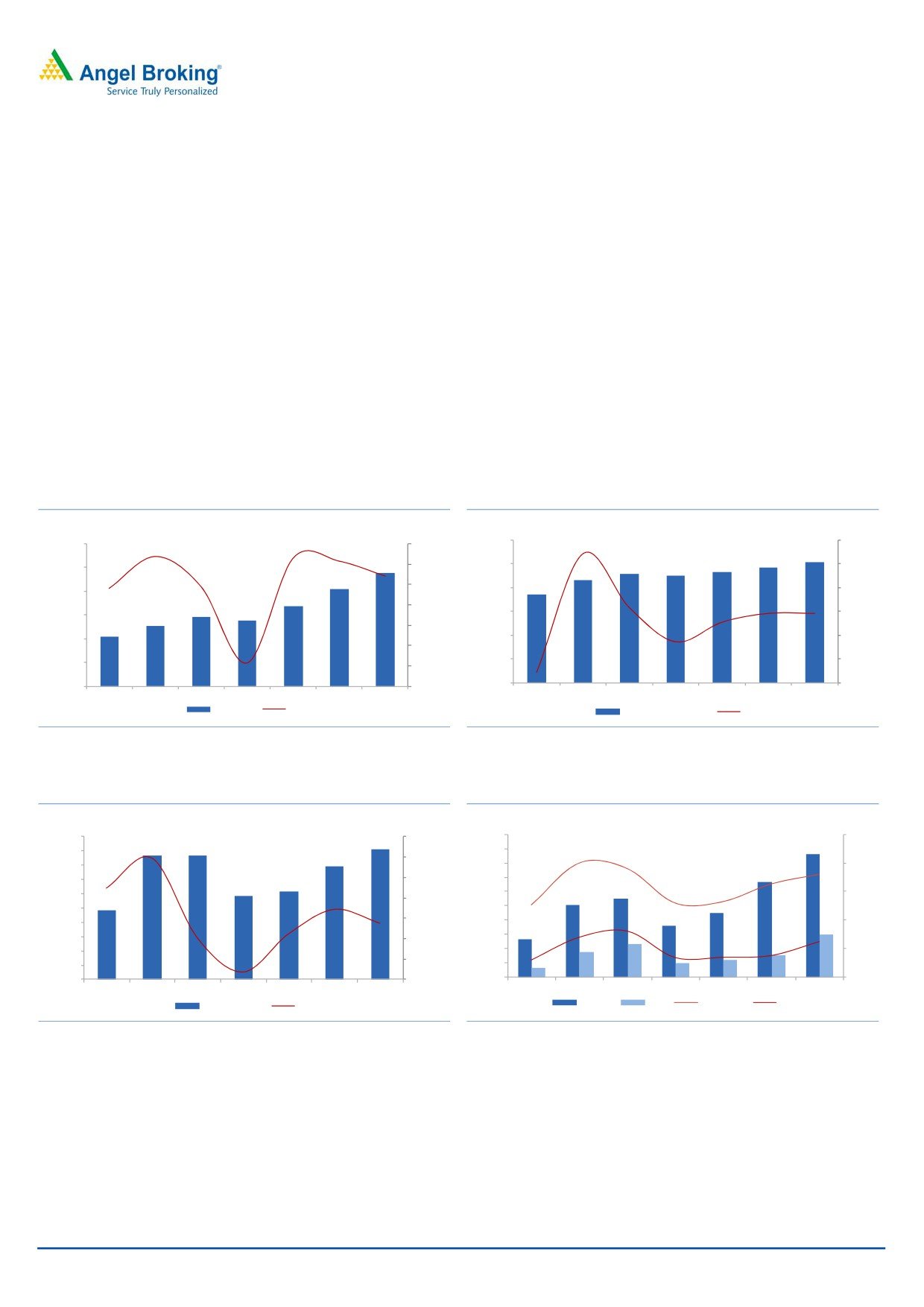

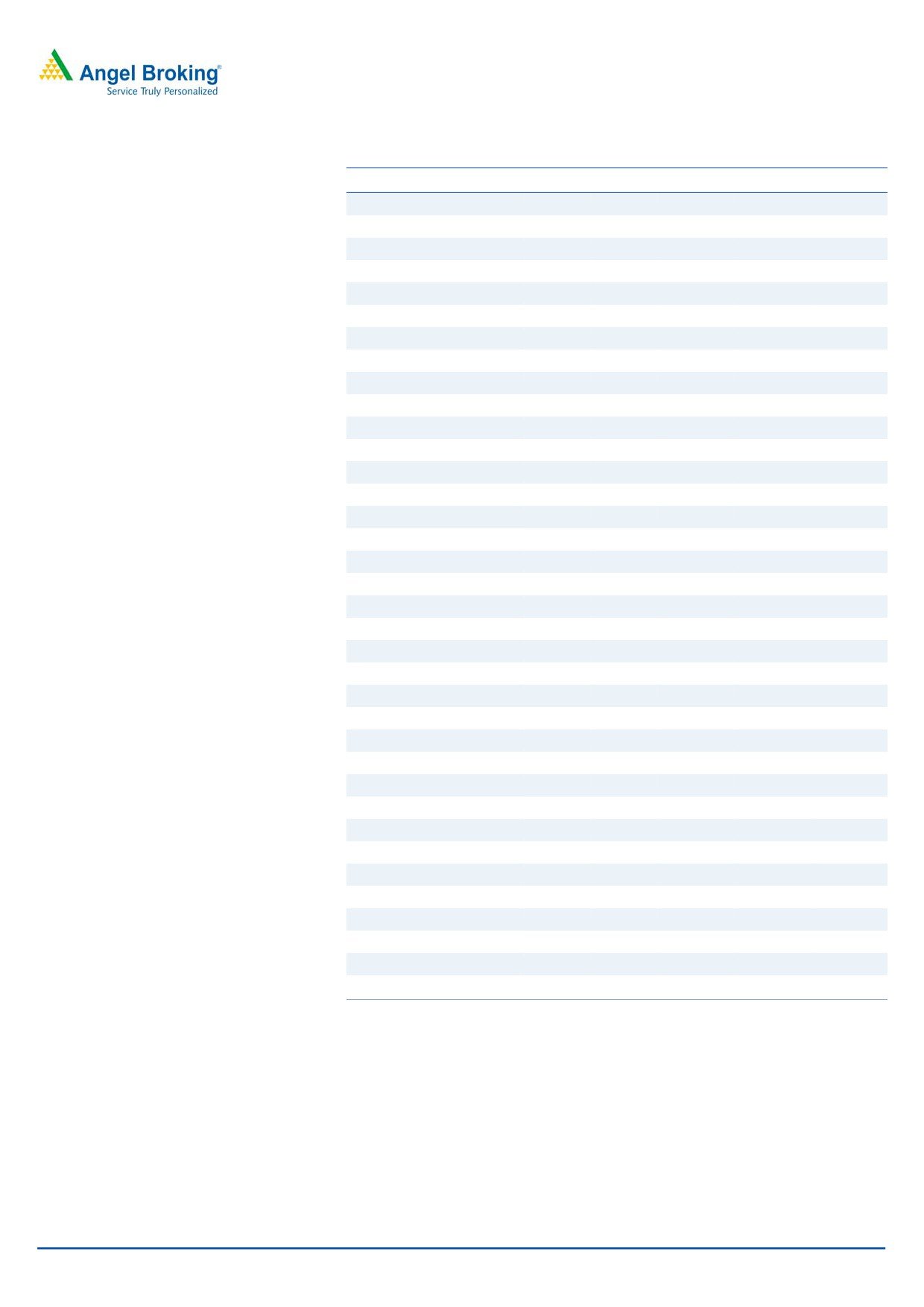

Exhibit 2: Grey Cement capacity and utilization level

Exhibit 3: Grey cement volume growth trend

(mn

tn)

(%)

(mn

tn)

(%)

12.0

90.0

80.9

9.0

25.0

76.0

80.0

19.5

71.2

71.6

8.0

10.0

68.9

71.5

20.2

20.0

61.4

70.0

7.0

16.7

8.0

60.0

8.4

15.0

6.0

13.

0

7.5

50.0

5.0

6.4

10.0

6.0

5.7

5.3

5.4

7.5

7.5

10.5

10.5

10.5

40.0

7.5

7.5

4.0

6.2

5.0

4.0

30.0

5.1

3.0

4.2

0.0

20.0

2.0

2.0

10.0

(5.3)

-5.0

1.0

0.0

0.0

0.0

-10.0

FY11

FY12

FY13

FY14

FY15E

FY16E

FY17E

FY11

FY12

FY13

FY14

FY15E

FY16E

FY17E

Capacity(mn tonnes)

Capacity utilization(%)

Sales Volume

yoy%

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 4: Pre Expansion Grey cement capacity

Exhibit 5: Post Expansion Grey cement capacity

40%

29%

60%

71%

North

South

North

South

Source: Company, Angel Research

Source: Company, Angel Research

March 12, 2015

3

Initiating coverage | JK Cement

Top 2 players in White cement business: JKCem has a white cement capacity of

0.6mtpa in Gotan, Rajasthan. There are only two major players manufacturing

white cement, one is JKCem itself and the other being UltraTech Cement. Thus, the

utilization level is healthy, led by stable demand for white cement. White cement

contributed 31% to JKCem’s top-line in FY2014. White cement realization is

almost 2.5x times that of grey cement in FY2014; white cement realization was

`10,706 while that of grey cement realization was `3,591. White cement’s EBITDA

margins are higher and more consistent at 25-28% while grey cement’s margins

have been volatile over the years.

The company has doubled its white cement capacity to 1.2mtpa by starting

production at a 0.6mtpa plant in UAE. We expect white cement volume to grow at

a CAGR of 7.0% over FY2014-17. As white cement has steady demand, we expect

realization to remain strong and grow at a CAGR of 3.4% over FY2014-17.

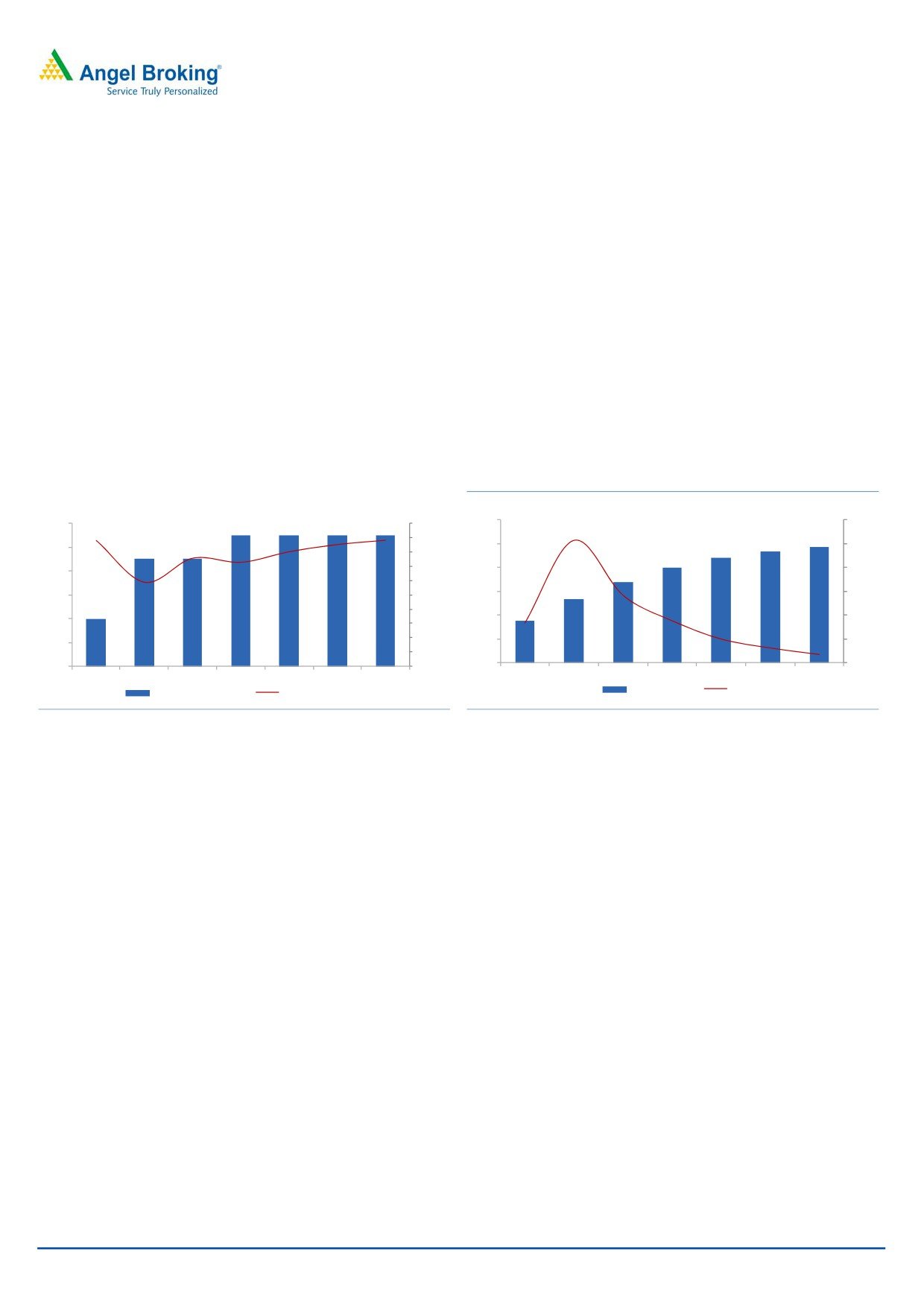

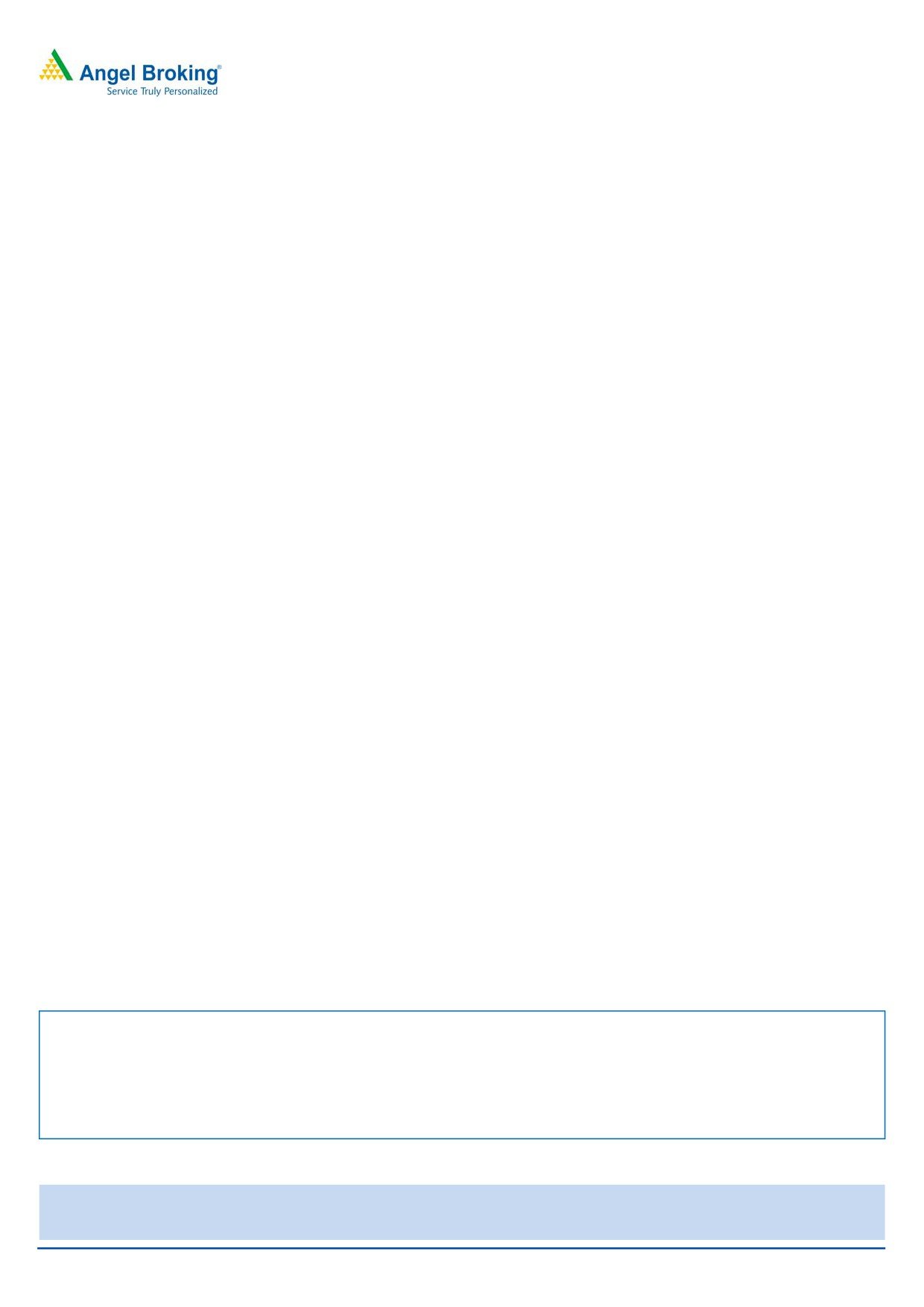

Exhibit 6: White Cement+Putty capacity and utilization level

Exhibit 7: White cement+Putty volume growth trend

(mn

tn)

(%)

(mn

tn)

(%)

1.2

60.0

1.2

100.0

85.0

80.0

88.090.0

51.3

87.8

1.0

50.0

1.0

80.0

1.72.7

70.0

0.8

0.9

1.0

40.0

0.8

0.9

0.9

75.6

60.0

0.8

58.9

1.1

1.1

0.6

30.0

0.6

1.1

50.0

28.3

0.9

40.0

0.7

0.4

0.4

0.5

20.0

30.0

16.7

17.6

0.4

20.0

0.2

0.4

10.0

10.0

0.2

6.3

10.0

3.5

0.0

0.0

0.0

0.0

FY11

FY12

FY13

FY14

FY15E

FY16E

FY17E

FY11

FY12

FY13

FY14

FY15E

FY16E

FY17E

sales volumes

yoy %

Capacity(mn tonnes)

Capacity utilization(%)

Source: Company, Angel Research

Source: Company, Angel Research

March 12, 2015

4

Initiating coverage | JK Cement

EBITDA to grow multifold on back by margin improvement: We expect JKCem’s

net sales to grow at a CAGR of 19.7% over FY2014-17, backed by strong volume

and healthy realization growth. The new plant addition will improve efficiency and

lead distance will be reduced as these plants are in close vicinity to the market. As

a result, freight cost is expected to come down. The plant will also enjoy 50% VAT

exemption for the next seven years for the goods sold in their respective states of

manufacture, ie Rajasthan and Haryana. Therefore we expect EBITDA to grow at a

CAGR of 33.6% over FY2014-17 on back of strong top-line growth and

operational efficiency. The EBITDA/tonne is also expected to improve from `585 in

FY2014 to `913 by FY2017. We expect blended margins to expand significantly

from 13.0% in FY2014 to 18.0% in FY2017.

Exhibit 8: Realization per tonne comparison

Exhibit 9: Total cost per tonne comparison

Company

FY2010

FY2011

FY2012

FY2013

FY2014

Company

FY2010

FY2011

FY2012

FY2013

FY2014

Shree Cement

3,457

3,233

3,677

3,760

3,738

Shree Cement

2,351

2,724

2,994

3,268

3,163

Ramco Cement

3,330

3,389

4,098

4,339

4,076

Ramco Cement

2,422

2,721

3,082

3,335

3,633

India Cement

3,351

3,380

4,209

4,362

4,180

India Cement

2,804

3,088

3,466

3,735

3,892

JK Lakshmi

3,192

2,979

3,461

3,772

3,452

JK Lakshmi

2,288

2,576

2,943

3,068

3,117

JK Cement*

3,503

3,234

3,753

3,836

3,591

JK Cement*

3,046

3,329

3,464

3,710

3,930

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 10: Raw material cost per tonne comparison

Exhibit 11: Freight cost per tonne comparison

Company

FY2010

FY2011 FY2012 FY2013 FY2014

Company

FY2010

FY2011

FY2012

FY2013

FY2014

Shree Cement

325

358

421

424

315

Shree Cement

487

639

709

742

837

Ramco Cement

496

535

581

626

803

Ramco Cement

594

646

744

920

961

India Cement

457

506

572

556

573

India Cement

563

715

793

954

1,006

JK Lakshmi

501

463

778

918

979

JK Lakshmi

542

598

701

795

812

JK Cement*

371

477

522

570

689

JK Cement*

827

882

833

946

1,028

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 12: Power cost per tonne comparison

Exhibit 13: EBITDA per tonne comparison

Company

FY2010

FY2011

FY2012

FY2013

FY2014

Company

FY2010

FY2011

FY2012

FY2013

FY2014

Shree Cement

651

960

1,056

1,227

970

Shree Cement

1,526

938

1,159

1,247

969

Ramco Cement

743

904

971

956

969

Ramco Cement

1,068

845

1,221

1,138

596

India Cement

952

1,022

1,150

1,249

1,272

India Cement

790

352

805

683

338

JK Lakshmi

623

889

876

766

750

JK Lakshmi

912

416

694

809

536

JK Cement*

903

1,014

1,117

1,126

1,094

JK Cement*

964

483

866

871

585

Source: Company, Angel Research

Source: Company, Angel Research

Note: JK Cement realization is for grey cement, while cost and EBITDA per tonne are on blended

basis (including white cement).

March 12, 2015

5

Initiating coverage | JK Cement

Financial outlook

We expect JKCem to report healthy 19.7% revenue CAGR over FY2014-17E. This

would be on the back of strong volume growth with new capacity having begun

operation during 1HFY2015, and better cement demand outlook which will lead to

higher realizations. We expect blended realization to grow at a CAGR of 3.9% over

FY2014-17. Blended realization per tonne will improve from `4,515 in FY2014 to

`5,070 in FY2017. In FY2014, the company’s EBITDA declined sharply by 34.7%

yoy to `361cr vs `552cr in FY2013, while its EBITDA margin declined to 13.0% vs

19.0% in FY2013 due to fall in realizations. Going forward we expect the EBITDA

margin to improve due to higher realizations and operational efficiency of the

company. The EBITDA margin is expected to improve from 13.0% in FY2014 to

18.0% by FY2017E. Overall we expect EBITDA to grow at a CAGR of 33.6% over

FY2014-17E. With better profitability, we expect JKCem’s RoE to improve from

current levels of 6.4% to 14.3% by FY2017E.

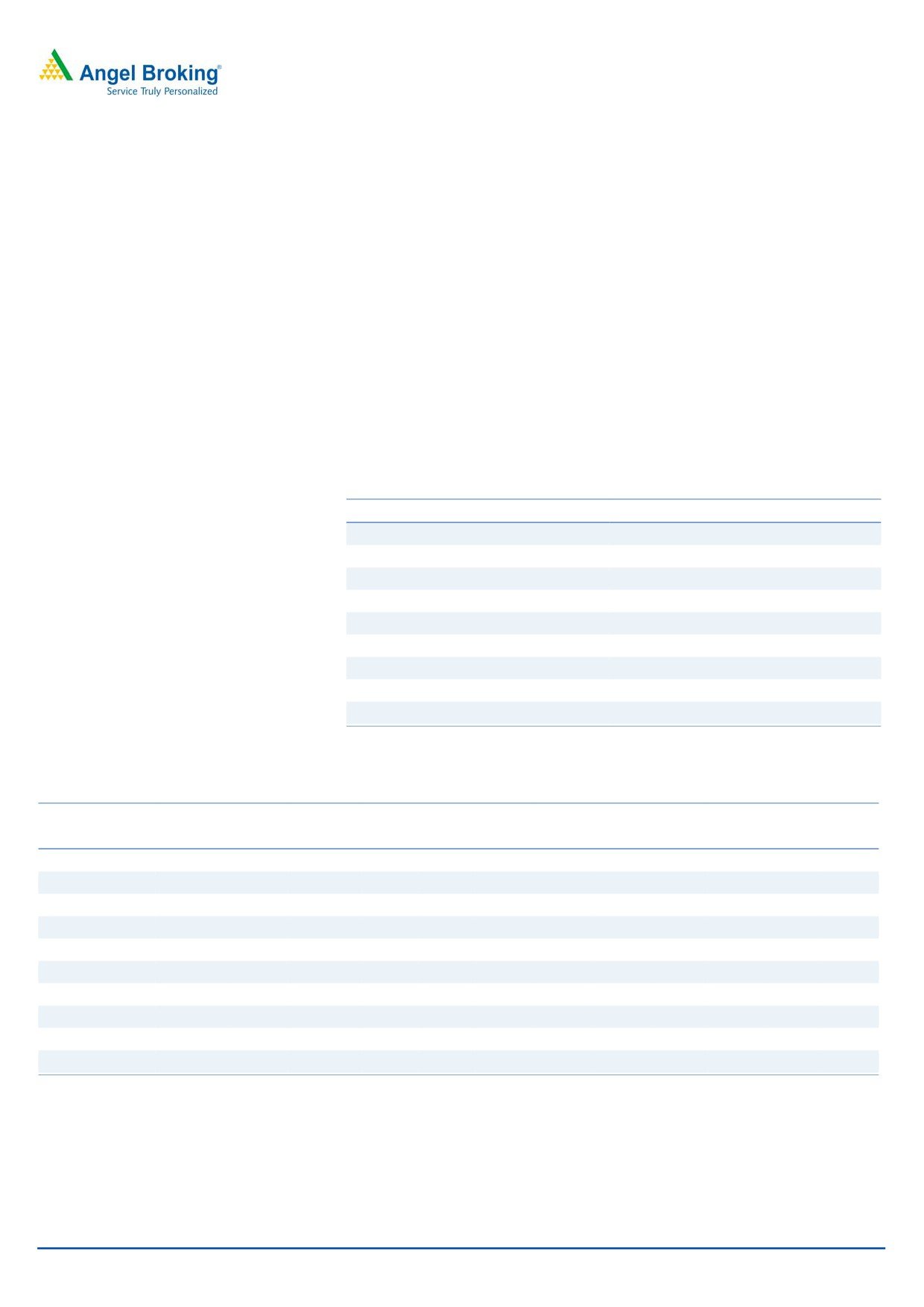

Exhibit 14: Revenue growth trend

Exhibit 15: Expected Blended Realization growth

(`

cr)

(%)

(`

mn/tn)

(%)

21.5

6,000

20.0

6,000

25.0

17.1

21.8

5,070

20.7

4,849

20.0

5,000

4,581

4,515

4,637

15.0

5,000

4,772

4,331

14.0

14.4

4,077

17.0

15.0

4,000

3,697

10.0

4,000

3,378

10.0

5.8

2.7

4.6

2,904

2,782

3,000

5.0

3,000

2,538

4.6

2,083

5.0

2,000

2,000

0.0

0.0

(1.4)

1,000

1,000

(5.0)

(4.2)

(5.0)

(7.8)

0

(10.0)

-

(10.0)

FY11

FY12

FY13

FY14

FY15E FY16E FY17E

FY11

FY12

FY13

FY14

FY15E FY16E FY17E

Net Sales

% chg

Blended Realization

yoy%

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 16: Expect improvement in EBITDA/tonne

Exhibit 17: Profitability Trend

(` cr)

(%)

(`

mn/tn)

(%)

1000

913

100.0

1000

25.0

900

860

900

20.0

79.4

80.0

800

20.0

800

866

871

19.0

792

666

18.0

700

49.9

60.0

700

552

13.2

16.3

600

600

12.7

508

13.0

15.0

614

40.0

585

28.9

500

448

500

483

20.0

400

361

10.0

400

15.3

8 .0

297

4.9

300

264

7.0

300

0.5

0.0

234

177

120

157

200

200

6.2

5 .0

3 .1

97

(20.0)

100

64

3.8

100

3.5

(32.8)

3 .5

0

(40.0)

0

0 .0

FY11

FY12

FY13

FY14

FY15E FY16E FY17E

FY11

FY12

FY13

FY14

FY15E

FY16E

FY17E

EBIDTA/tonne

% chg

EBITDA

PAT

EBITDA %

PAT %

Source: Company, Angel Research

Source: Company, Angel Research

March 12, 2015

6

Initiating coverage | JK Cement

Outlook and Valuation

The Indian cement industry has had a challenging time in the recent past due to

overcapacity and lack of demand. Going forward, as the macro economy

improves and with the government’s renewed focus on housing and infrastructure,

the demand scenario for the cement industry is expected to improve as well. With

the pace of capacity addition slowing down, we expect utilization levels to improve,

going forward. Companies which have added capacity in the recent past or are on

the verge of project completion are to benefit the most from this demand pick up.

At CMP of `673 the stock is trading at 9.9x and 7.5x its FY2016E and FY2017E

EV/EBITDA (blended), respectively. We initiate coverage on JK Cement with an Buy

recommendation and target price of `778 based on 8.0x grey cement and 9.0x

white cement FY17 EV/EBIDTA; the target price implies EV/tonne of $100 (on

blended capacity of 11.6mtpa).

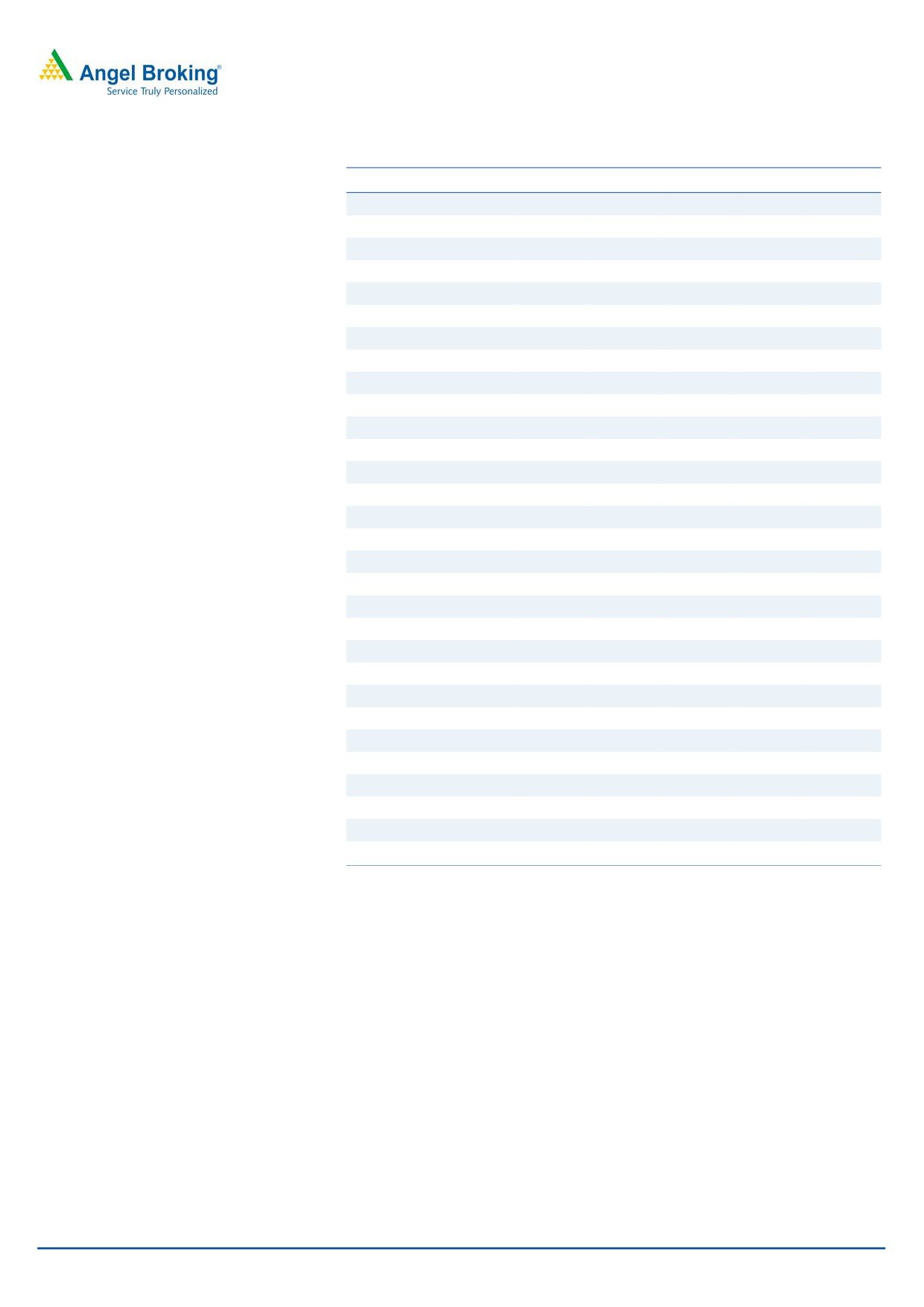

Exhibit 18: JK Cement SOTP valuation

(` in cr)

EV/EBITDA

FY2017E

Grey Cement

8.0

4500

White Cement

9.0

2675

Overseas Operation

8.0

700

EV

7875

Consolidated Net Debt

2434

Market cap

5441

Target Price (`)

778

Upside

16%

CMP (`)

673

Source: Company, Angel Research

Exhibit 19: Valuation Table

Rating

CMP Target Price

P/E (x)

EV/EBITDA (x)

EV/tn (USD/tn)

Company

(`)

(`)

FY15E FY16E FY17E FY15E FY16E FY17E FY15E FY16E FY17E

ACC

Neutral

1,650

1,656

36.1

26.3

18.6

18.4

13.7

10.2

141

129

129

Ambuja Cement Neutral

264

234

28.2

27.1

23.5

18.7

14.8

12.8

207

206

204

India Cements

Buy

99

146

84.5

27.3

16.6

11.8

7.6

6.5

73

65

63

JK Lakshmi Cem Buy

379

443

25.9

20.8

13.6

13.1

9.1

7.2

105

94

88

Mangalam Cement Buy

289

360

23.5

11.8

8.3

9.3

6.3

4.8

43

45

42

Orient Cement

Neutral

176

183

22.1

23.2

14.3

10.6

10.0

7.3

95

90

85

The Ramco CementAccumulate

321

350

40.1

23.9

16.1

15.8

11.4

8.5

114

108

99

Shree Cement

Neutral

10,700

9,852

43.0

46.9

31.0

25.5

18.3

13.5

303

250

221

Ultratech Cement Buy

3,001

3,534

36.0

24.6

18.6

18.6

13.5

10.5

221

194

175

JK Cement

Buy

673

778

39.4

30.0

15.8

15.7

10.4

7.7

100

98

94

Source: Company, Angel Research

March 12, 2015

7

Initiating coverage | JK Cement

Company Background

JK Cement is one of the leading cement producers in India with installed grey

cement capacity of 10.5mtpa (7.5mtpa capacity is located in the North region

[Rajasthan and Haryana] and the remaining 3mtpa capacity is located in the South

region [Karnataka]). JKCem is the second largest white cement producer in India

with installed capacity of 0.6mtpa. The company also has a 0.5mtpa wall putty

capacity in Gotan, Rajasthan. The company also has a 0.6mtpa white cement

plant in UAE to tap the growing Middle East and African markets. JKCem was the

first company to install a captive power plant in 1987 at Rajasthan and now it has

total power capacity of 140MW. The company sells cement under the brands - JK

Cement and JK Super Cement.

Exhibit 20: Plant Locations

Grey Cement Capacity

Plant Location

State

Region

Capacity (MTPA)

Nimbahera

Rajasthan

North

3.25

Mangrol*

Rajasthan

North

2.25

Gotan

Rajasthan

North

0.5

Jhajjar*

Haryana

North

1.5

Muddapur

Karnataka

South

3

Total Grey Cement Capacity

10.5

White Cement Capacity

Plant Location

State

Region

Capacity (MTPA)

Gotan

Rajasthan

North

0.6

UAE

0.6

Total White Cement Capacity

1.2

Source: Company, Angel Researc; Note: *New capacity (1.5mtpa at each location)added during 1HFY2015

March 12, 2015

8

Initiating coverage | JK Cement

Profit & Loss Statement (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015E FY2016E FY2017E

Net Sales

2,904

2,782

3,378

4,077

4,772

% chg

14.4

(4.2)

21.5

20.7

17.0

Total Expenditure

2,352

2,421

2,931

3,411

3,913

Net Raw Materials

362

425

564

668

765

Power & Fuel cost

714

674

813

948

1,092

Personnel

158

168

186

224

262

Other

1,118

1,155

1,368

1,571

1,793

EBITDA

552

361

448

666

860

% chg

8.7

(34.7)

24.1

48.8

29.1

(% of Net Sales)

19.0

13.0

13.2

16.3

18.0

Depreciation& Amortisation

128

134

147

182

208

EBIT

424

227

300

484

652

% chg

10.9

(46.5)

32.6

61.1

34.6

(% of Net Sales)

14.6

8.1

8.9

11.9

13.7

Interest & other Charges

140

153

221

288

248

Other Income

57

62

61

28

22

(% of PBT)

16.6

45.7

43.4

12.5

5.1

Recurring PBT

341

136

141

224

425

% chg

16.0

(60.0)

3.2

59.1

89.9

Extraordinary Expense/(Inc.)

-

-

-

-

-

PBT (reported)

341

136

141

224

425

Tax

107

39

21

67

127

(% of PBT)

31.4

28.8

15.0

30.0

30.0

PAT (reported)

234

97

120

157

297

ADJ. PAT

234

97

120

157

297

% chg

26.1

(58.5)

23.2

31.1

89.9

(% of Net Sales)

8.0

3.5

3.5

3.8

6.2

Basic EPS (`)

33

14

17

22

43

Fully Diluted EPS (`)

33

14

17

22

43

% chg

21.0

(58.5)

23.2

31.1

89.9

March 12, 2015

9

Initiating coverage | JK Cement

Balance Sheet (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015E FY2016E FY2017E

SOURCES OF FUNDS

Equity Share Capital

70

70

70

70

70

Reserves& Surplus

1,627

1,689

1,780

1,900

2,128

Shareholders Funds

1,697

1,758

1,850

1,970

2,198

Total Loans

1,272

2,320

2,620

2,395

2,120

Deferred Tax Liability

249

268

268

268

268

Other Long term liabilities

87

97

97

97

97

Total Liabilities

3,305

4,445

4,836

4,731

4,684

APPLICATION OF FUNDS

Gross Block

3,087

3,180

4,900

5,050

5,200

Less: Acc. Depreciation

722

868

1,015

1,197

1,405

Net Block

2,364

2,313

3,886

3,854

3,796

Capital Work-in-Progress

108

1,102

82

82

82

Investments

169

300

300

300

300

Current Assets

1,261

1,389

1,360

1,335

1,402

Inventories

461

542

615

687

756

Sundry Debtors

115

112

131

147

172

Cash

332

348

189

85

61

Loans & Advances

345

373

411

402

398

Other

7

14

14

14

14

Current liabilities

597

658

791

839

895

Net Current Assets

664

731

569

496

507

Total Assets

3,305

4,445

4,836

4,731

4,684

March 12, 2015

10

Initiating coverage | JK Cement

Cash Flow Statement (Standalone)

Y/E March

FY2013

FY2014

FY2015E FY2016E FY2017E

Profit before tax

341

136

141

224

425

Depreciation

128

134

147

182

208

Change in Working Capital

(123)

(51)

3

(31)

(35)

Less: Other income

57

62

61

28

22

Direct taxes paid

107

39

21

67

127

Cash Flow from Operations

182

117

209

279

449

(Inc)/ Decin Fixed Assets

(209)

(1,088)

(700)

(150)

(150)

(Inc)/ Dec in Investments

(158)

(130)

-

-

-

Other income

57

62

61

28

22

Cash Flow from Investing

(311)

(1,156)

(639)

(122)

(128)

Issue of Equity

Inc./(Dec.) in loans

84

1,078

300

(225)

(275)

Dividend Paid (Incl. Tax)

53

25

28

37

70

Others

2

(0)

-

-

-

Cash Flow from Financing

28

1,054

272

(262)

(345)

Inc./(Dec.) in Cash

(100)

15

(158)

(104)

(24)

Opening Cash balances

433

332

348

189

85

Closing Cash balances

332

348

189

85

61

March 12, 2015

11

Initiating coverage | JK Cement

Key Ratios

Y/E March

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

20.2

48.5

39.4

30.0

15.8

P/CEPS

13.0

20.4

17.7

13.9

9.3

P/BV

2.8

2.7

2.5

2.4

2.1

Dividend yield (%)

1.0

0.4

0.5

0.7

1.3

EV/Sales

1.9

2.0

2.1

1.7

1.4

EV/EBITDA

10.2

15.4

15.7

10.4

7.7

EV / Total Assets

1.7

1.2

1.5

1.5

1.4

Per Share Data (`)

EPS (Basic)

33.4

13.9

17.1

22.4

42.5

EPS (fully diluted)

33.4

13.9

17.1

22.4

42.5

Cash EPS

51.7

33.0

38.1

48.4

72.3

DPS

6.5

3.0

3.4

4.5

8.5

Book Value

242.7

251.5

264.6

281.7

314.3

Dupont Analysis

EBIT margin

14.6

8.1

8.9

11.9

13.7

Tax retention ratio

68.6

71.2

85.0

70.0

70.0

Asset turnover (x)

1.0

0.8

0.8

0.9

1.0

ROIC (Post-tax)

10.4

4.6

5.8

7.3

9.8

Cost of Debt (Post Tax)

7.7

6.0

7.6

8.1

7.7

Leverage (x)

0.5

0.7

1.1

1.1

0.9

Operating ROE

11.7

3.5

4.0

6.5

11.8

Returns (%)

ROCE (Pre-tax)

13.3

5.8

6.5

10.1

13.8

Angel ROIC (Pre-tax)

16.2

8.4

8.6

11.4

15.3

ROE

16.9

6.4

7.0

8.2

14.3

Turnover ratios (x)

Asset Turnover (Gross Block)

1.0

0.9

0.8

0.8

0.9

Inventory / Sales (days)

52

66

62

58

55

Receivables (days)

13

15

13

12

12

Payables (days)

87

95

90

87

81

WC cycle (ex-cash) (days)

34

47

41

35

33

Solvency ratios (x)

Net debt to equity

0.5

1.0

1.2

1.0

0.8

Net debt to EBITDA

1.4

4.6

4.8

3.0

2.0

Interest Coverage (EBIT / Int.)

3.0

1.5

1.4

1.7

2.6

March 12, 2015

12

Initiating coverage | JK Cement

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel has received in-principal approval

from SEBI for registering as a Research Entity in terms of SEBI (Research Analyst) Regulations, 2014. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates

including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by

Analyst. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months. Angel/analyst has not served as an officer, director or employee of

company covered by Analyst and has not been engaged in market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

JK Cement

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15

March 12, 2015

13